Table Of Contents

Ecommerce Platforms Enabling Click to Pay

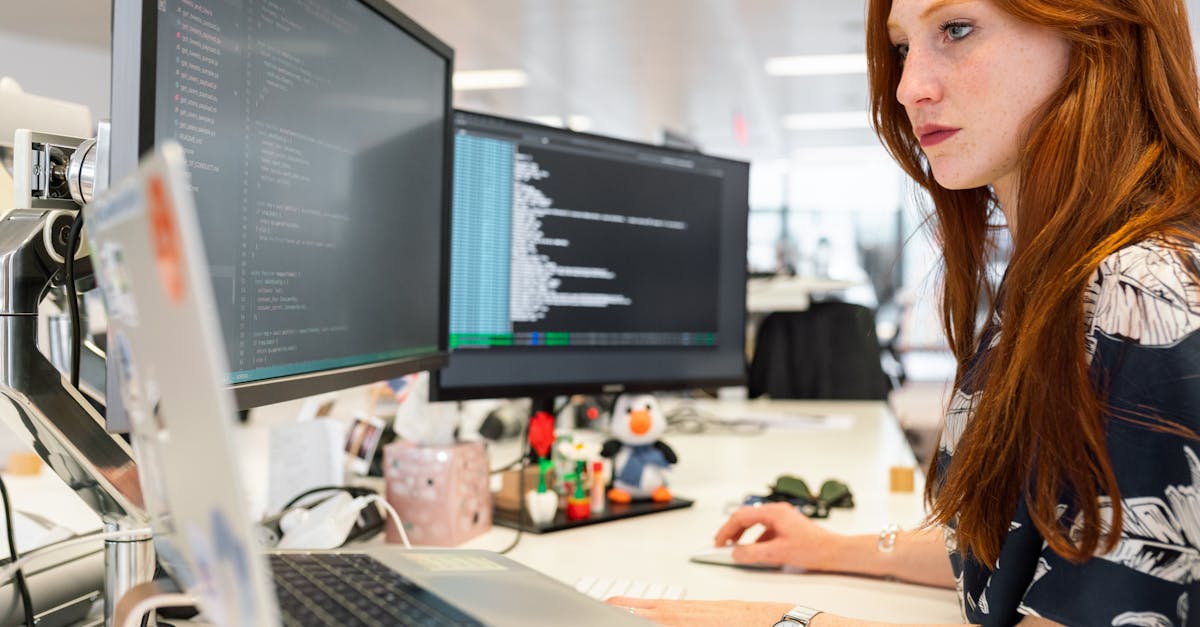

E-commerce platforms have increasingly integrated click to pay features to streamline the purchasing process. These platforms allow customers to complete transactions with minimal friction. Popular platforms like Shopify and WooCommerce offer various tools for merchants to enable click to pay, aiming to enhance the shopping experience. Users benefit from faster checkouts, which can lead to increased conversion rates for sellers.

In addition to traditional payment options, many e-commerce websites are exploring the benefits of Pay-Per-Click (PPC) Advertising. This model not only helps drive traffic to product pages but also supports businesses by bringing potential buyers closer to making a purchase. By combining click to pay with effective PPC strategies, merchants can provide a seamless path for customers, ultimately boosting sales and improving overall customer satisfaction.

Marketplaces Incorporating Click to Pay Features

Marketplaces have rapidly adopted click to pay features to streamline the purchasing process for their users. This innovation allows customers to make payments with just a single click, enhancing the overall shopping experience. By integrating this functionality, platforms can cater to the increasing demand for efficiency and convenience, especially in today’s fast-paced digital environment. These marketplaces not only facilitate quick transactions but also improve customer retention by providing an easier pathway to complete purchases.

In addition to improving user experience, the inclusion of click to pay can positively influence marketing strategies. Marketplaces can leverage Pay-Per-Click (PPC) Advertising to attract traffic and convert visits into sales more effectively. The seamless checkout provided by click to pay can help in retaining users who may have been deterred by lengthy payment processes. With the right measures in place, these platforms can capitalise on the synergy between streamlined payments and targeted advertising campaigns, ultimately driving greater business outcomes.

Benefits of Using Click to Pay

Click to Pay offers numerous benefits for both consumers and merchants. For consumers, the primary advantage is convenience. Shoppers can complete purchases quickly with just a few clicks, which reduces the hassle of long check-out processes. This speed enhances user experience and can lead to increased customer satisfaction. Merchants benefit as well; faster transactions can lead to higher conversion rates, ultimately boosting sales. By simplifying the payment process, businesses can attract and retain customers more effectively.

Another important aspect of Click to Pay is its compatibility with existing marketing strategies, such as Pay-Per-Click (PPC) Advertising. This synergy allows businesses to optimise their ad spend while driving traffic directly to checkout pages. The ability to seamlessly integrate payment options into marketing campaigns enhances overall efficiency and effectiveness. As a result, merchants can reap the rewards of their advertising investments while providing customers with a streamlined shopping experience.

Advantages for Consumers and Merchants

Consumers enjoy a seamless shopping experience with the introduction of click to pay features. The process significantly reduces the time spent on transactions, allowing users to make purchases with just a few clicks. This convenience often leads to more impulsive buying decisions, as the barriers to completing a purchase are lowered. Additionally, many platforms offering click to pay have integrated loyalty programs and exclusive deals, which can enhance customer satisfaction and retention.

For merchants, adopting click to pay can result in increased sales and customer acquisition. Fewer abandoned carts translate to higher conversion rates, directly impacting revenue. Those businesses leveraging Pay-Per-Click (PPC) Advertising can effectively drive targeted traffic to their sites, further capitalising on the efficiency of click to pay. Enhanced analytics from these platforms also enable merchants to better understand consumer behaviour, allowing for tailored marketing strategies that improve overall engagement and loyalty.

Security Measures for Click to Pay

Click to Pay systems employ a variety of security measures to protect both consumers and merchants during online transactions. Advanced encryption protocols ensure that sensitive information, such as credit card details and personal data, remains secure throughout the payment process. Additionally, multi-factor authentication adds an extra layer of security, requiring users to verify their identity through multiple means before completing a transaction. Such measures are crucial in building trust in the digital marketplace.

Moreover, as online payment methods continue to evolve, the integration of technologies like Pay-Per-Click (PPC) Advertising enhances user experience while maintaining stringent security standards. Monitoring and analysis tools are implemented to detect fraudulent activities in real-time, enabling swift action when suspicious behaviour is noted. These security strategies not only safeguard consumer data but also reassure merchants that their financial interests are being protected amidst the rapidly changing landscape of e-commerce.

How Click to Pay Ensures Safe Transactions

Click to Pay implements a variety of security measures designed to protect user information during transactions. By using tokenisation, sensitive details such as credit card numbers are transformed into secure tokens that cannot be easily compromised. This method helps to ensure that personal data does not remain exposed to potential threats, significantly reducing the risk of fraud. Additionally, many platforms employing Click to Pay are integrated with advanced encryption protocols, safeguarding data transmission between the consumer and merchant.

To further enhance security, Click to Pay often collaborates with established payment gateways, which adhere to stringent compliance standards. These gateways implement multi-layered authentication processes that require verification from users, making unauthorised access much more difficult. As a result, consumers can confidently engage in online shopping without fearing for their financial information. This environment parallels strategies like Pay-Per-Click (PPC) Advertising, where the emphasis on secure and reliable interactions contributes to overall trust in digital transactions.

FAQS

What is Click to Pay?

Click to Pay is a simplified online payment method that allows customers to complete transactions quickly by using a one-click process, reducing the need for manual entry of payment details.

Which e-commerce platforms offer Click to Pay?

Major e-commerce platforms such as Shopify, WooCommerce, and BigCommerce have incorporated Click to Pay features to streamline the checkout process for their users.

Are there any marketplaces that support Click to Pay?

Yes, popular marketplaces like eBay and Amazon have implemented Click to Pay options to enhance user experience and make transactions faster for their customers.

What are the benefits of using Click to Pay for consumers?

Consumers benefit from Click to Pay as it speeds up the purchasing process, reduces the chances of entering incorrect payment information, and often enhances security with tokenisation.

How does Click to Pay ensure secure transactions?

Click to Pay employs various security measures such as encryption, tokenisation, and multi-factor authentication to protect customers' financial information and ensure safe online transactions.